Ethereum is back. Arguably, even more importantly, Ethereum memecoins are back. The stronghold of Solana’s pump.fun memecoin launcher appears to be losing its grip as capital floods back into the Ethereum ecosystem.

The apparent rotation has helped push ETH’s price to over $3,000 for the first time in months, while established memecoins such as DOGE, SHIB, and NEIRO have all experienced impressive rallies.

Despite the good news for the Ethereum community, it’s important to recognize the damage that pump.fun has arguably done to Ethereum and the broader memecoin market. The impact of pump.fun on overall trust in the memecoin market has been immense; at the peak of the pump.fun madness, hundreds of projects were launching every day, with almost every single one of them ending in some sort of rug pull.

The crisis of trust in memecoins is a threat to anyone building a memecoin, even if it’s on Ethereum and has nothing to do with pump.fun. The solution is proper crypto marketing, more precisely, high-quality crypto influencer marketing that taps the most trusted key opinion leaders (KOLs) in the space.

Ethereum Memecoins: Recovery In Post-Pump.Fun Market

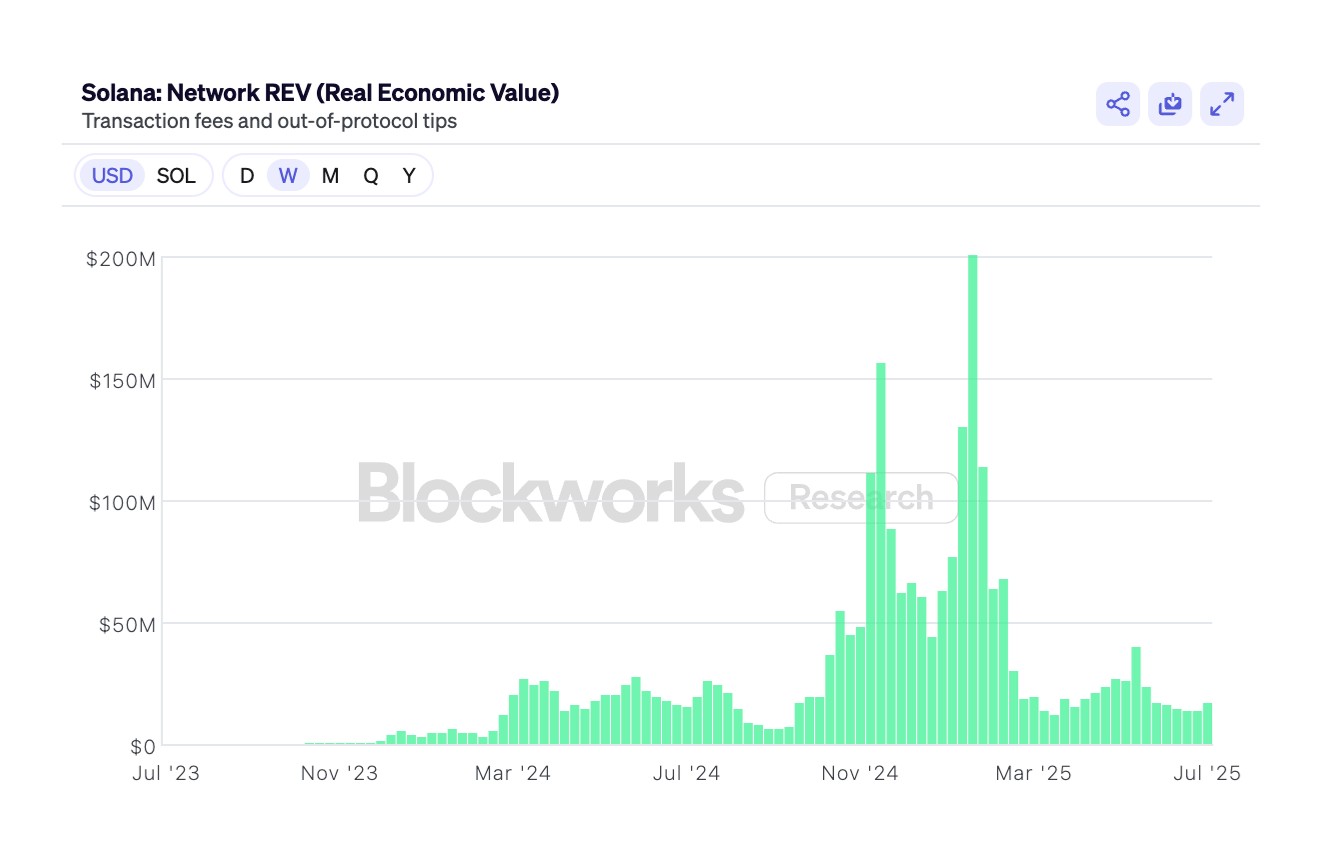

The pump.fun gold rush was impressive, regardless of how many of the projects ended up going to zero. At its peak, largely due to pump.fun, trading volume on Solana surged well above $100 billion per week, with revenue generation exceeding $200 million in the same timeframe.

For anyone who was active on pump.fun during this surge in activity, it quickly became obvious that something entirely new was gripping the memecoin market. The launching platform has made it possible to launch memecoins in seconds with no need for coding and at a very low cost.

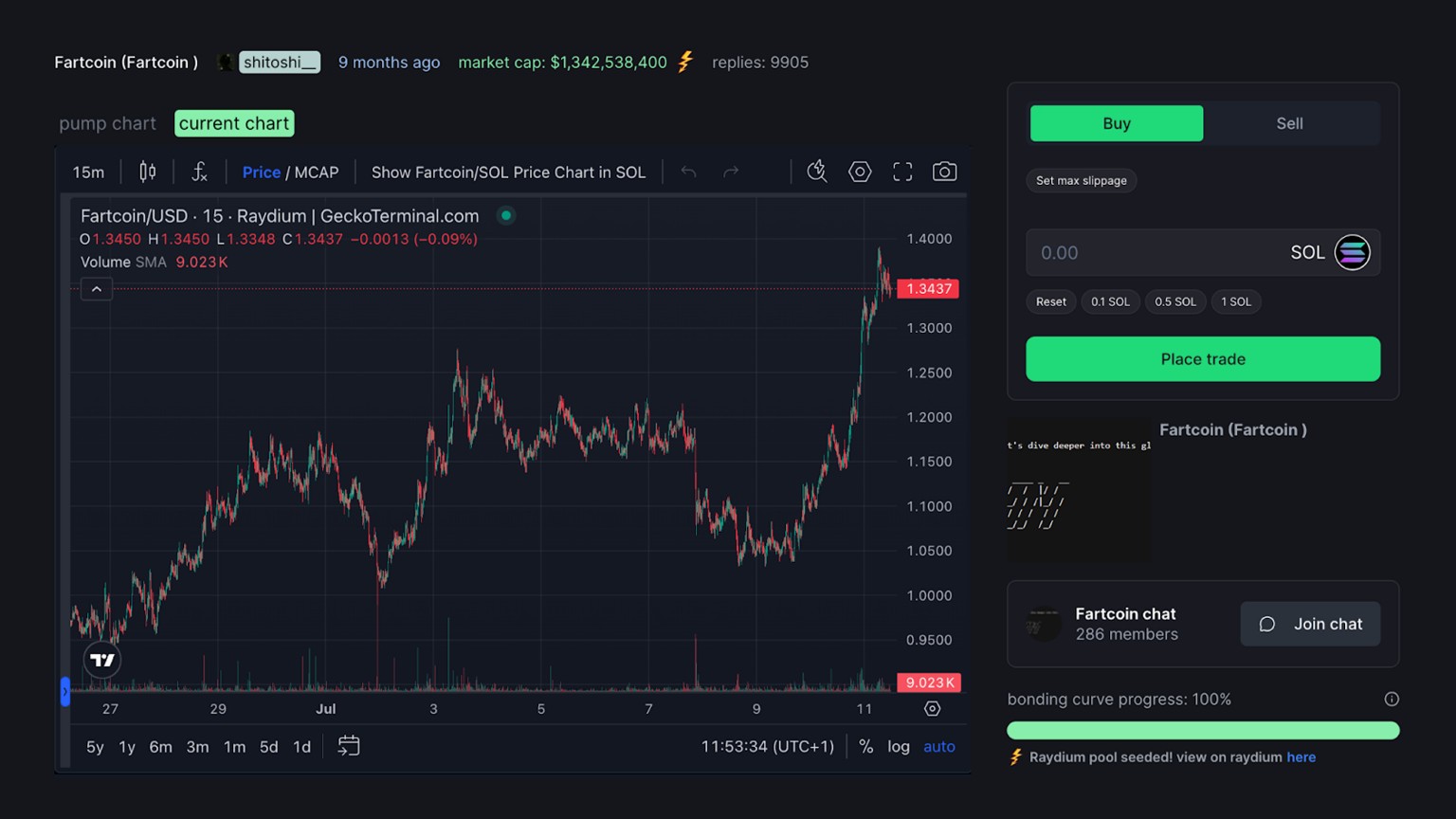

The outcome was fascinating. The headlines in the crypto space were dominated for weeks by the most successful pump.fun-based projects. Fartcoin (FART) is undoubtedly the most cited example. The project has zero utility yet quickly reached a market capitalization of over $2 billion (peaked at $2.34 billion, currently around $1.3 billion as of July 2025) and continues to trade well above $1 billion.

While the Solana community was cheering, the Ethereum community was sidelined. Liquidity was sucked out of Ethereum, ETH crashed below $2,000, and appetite for new memecoins on the OG smart contract platform dried up.

Many traders argued that pump.fun had put the final nail in Ethereum’s memecoin coffin. Why would anyone go back to paying Ethereum’s higher fees when they could be trying to find the next Fartcoin?

Fortunately for ETH holders (and for those of us who have gotten very tired of the pump.fun mania), Vitalik’s project has fought its way back into the spotlight, dragging its memecoins along for the ride. Ethereum’s price has rallied back above $3,000, supported by significant ETH spot ETF inflows.

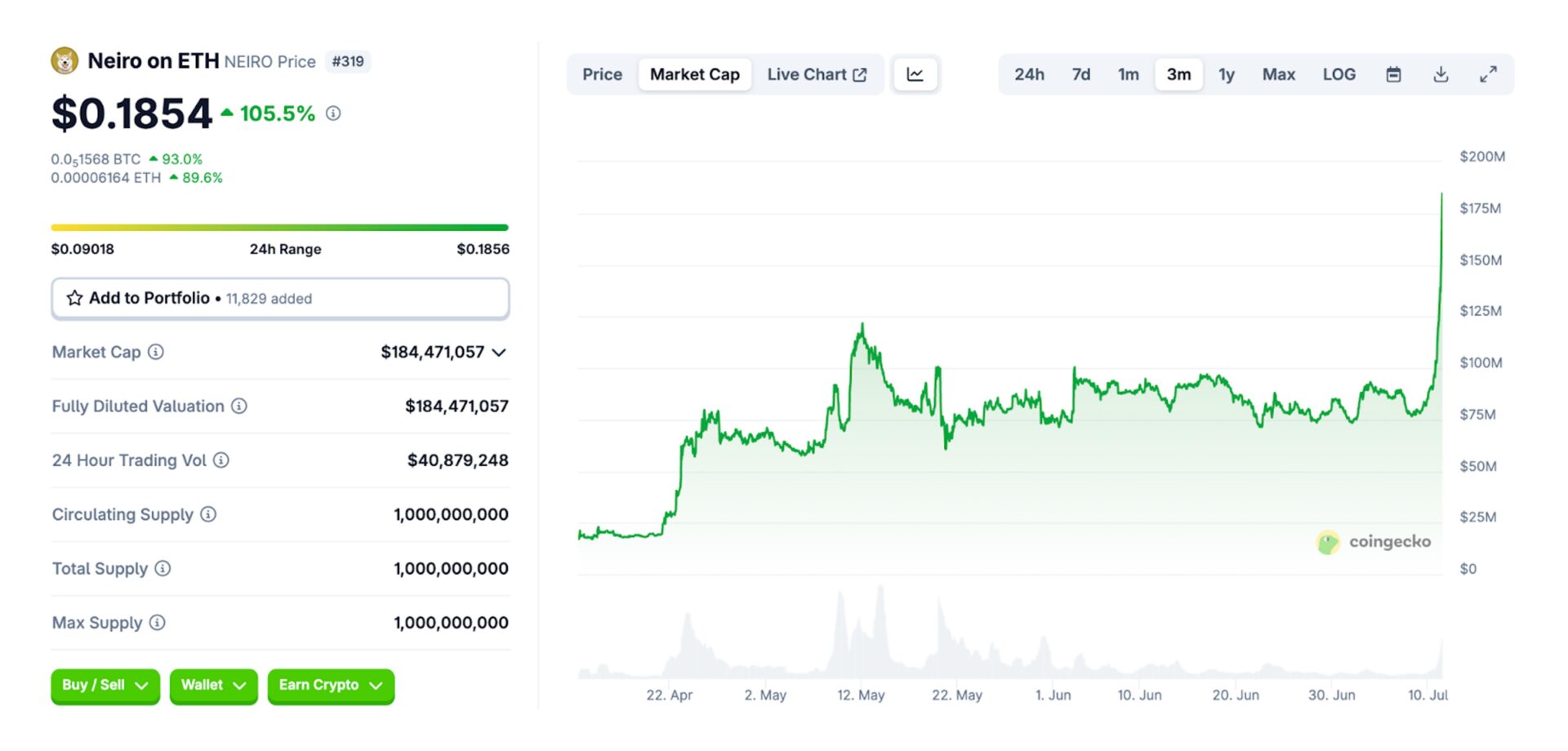

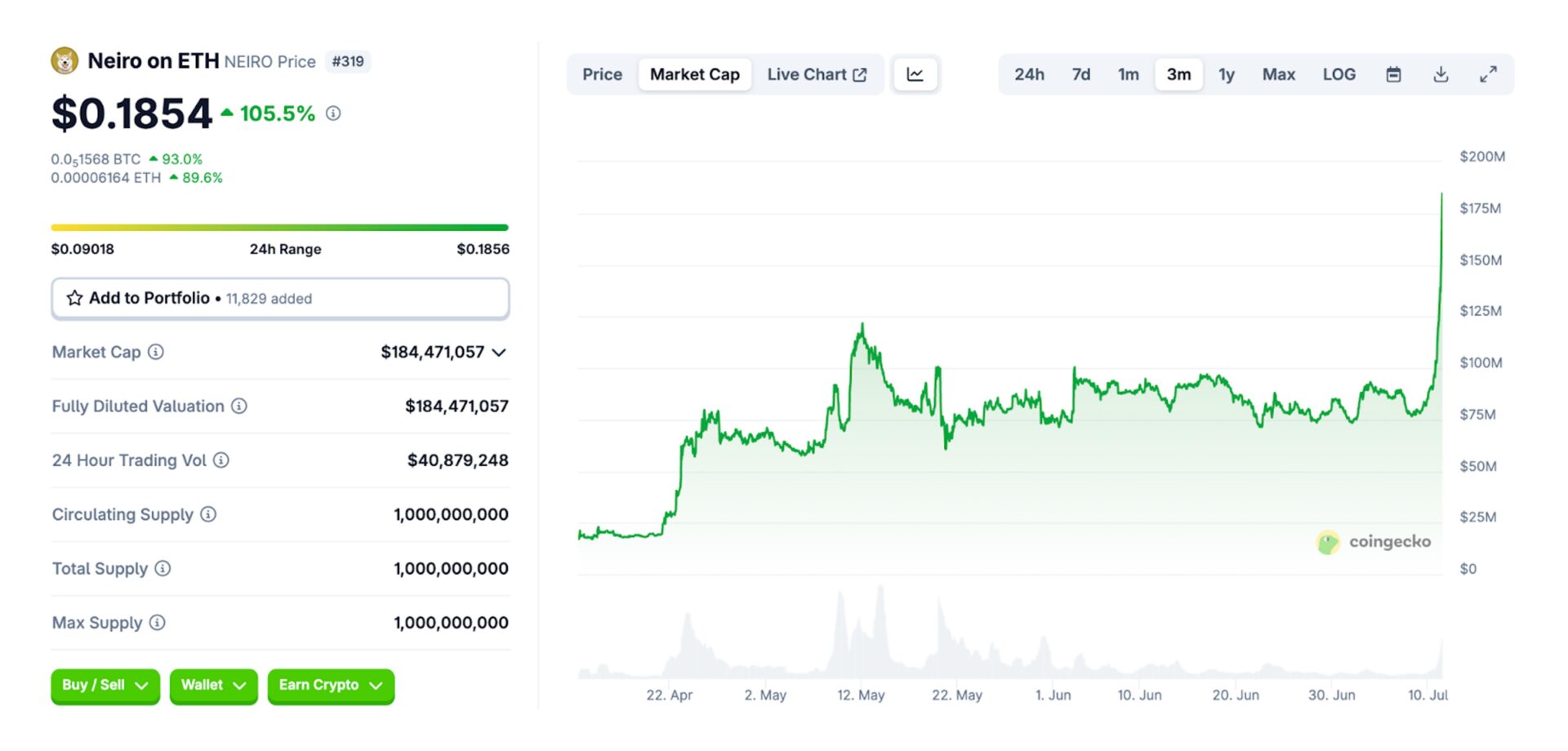

Several of its memecoins have seen massive price recoveries. NEIRO on ETH, for instance, has seen a recovery of over 100%, making up for some of its losses, while PEPE has also added over $1 billion to its market capitalization (current market cap around $4.89 billion as of July 2025).

New memecoins are also going live on Ethereum, many of them outshining Solana, as demand for memecoins with a long-term vision, as opposed to momentary pumps, appears to be recovering.

However, the pump.fun rug pulls have done considerable damage to the memecoin market in the form of a crisis of trust. KOLs are one of the ways to make up for this trust deficit.

The Power of Crypto KOL Marketing in a Trust-Deficient Industry

For anyone launching an Ethereum memecoin, building trust should be one of their most valued objectives. Memecoins that go the distance and grow into billion-dollar industry leaders like DOGE and SHIB have managed to build a massive amount of trust through a combination of effective decentralization and marketing.

A respected KOL’s endorsement can validate a project’s legitimacy in a skeptical market. Tier 1 KOLs with large, engaged followings instantly signal credibility to thousands of potential investors, cutting through the noise of unverified projects and establishing initial confidence. Their backing acts as a powerful form of social proof.

Tapping into a KOL’s established community attracts high-quality early adopters and fosters organic growth. When a KOL’s audience embraces a project, it rapidly expands its holder base, distributing tokens across many wallets. This broad distribution improves trust, reducing the danger of one bad actor manipulating the chart if many wallets hold bits of supply.

However, getting these KOLs involved in a project is no easy task; they are in high demand. Projects often allocate significant portions of their token supply for a single post or mention. Generally, the only way to access them is through expert crypto influencer marketing agencies, which possess established relationships and negotiation skills to secure these crucial partnerships.

The KOL Identification & Negotiation: Finding The Perfect KOL

Pinpointing the ideal KOLs for a campaign is just part of the battle. It’s important to have a long-term roadmap with different types of KOLs coming on board at various stages. Generally, leading projects rely on expert agencies to draft KOL calendars and then reach out to their experienced figures.

The agencies then tend to negotiate on behalf of the project to ensure a fair and balanced contract is reached with beneficial terms that don’t give up too much token supply or hand over too much of the supply in one chunk; this is to protect the price chart.

It’s worth getting into more details about the different types of KOLs, as their impact, cost, and suitability vary significantly. Understanding these tiers is crucial for effective budget allocation and campaign planning.

Tier 1 KOLs: These are the industry giants with millions of followers across platforms. They command the highest fees, often demanding significant token allocations or large upfront payments. While their reach is immense, their audience might be more general, and their direct engagement per follower can be lower.

Tier 2 KOLs: These influencers typically have hundreds of thousands of followers and a strong, engaged community within specific niches. They offer a good balance of reach and authenticity, making them ideal for broader campaigns seeking targeted exposure. Their costs are substantial but more accessible than Tier 1.

Tier 3 KOLs: This tier includes smaller influencers with highly engaged, niche communities, ranging from thousands to tens of thousands of followers. They are often perceived as more authentic and trustworthy due to their direct interaction with their audience. While their reach is smaller, a collective campaign with multiple Tier 3 KOLs can yield high conversion rates and be more cost-effective.

The important takeaway from KOL marketing is that it is one of the most effective ways to build trust around a new project. Regardless of whether a project is relying solely on Tier-1s or building a solid roster of smaller KOLs, this marketing tool can be extremely effective in rallying the community around Ethereum memecoins.

Crypto KOL Marketing Red Flags & Pitfalls to Avoid

There is a long list of red flags to keep an eye out for when it comes to KOL marketing. Many of these are also useful to keep in mind for developers who are considering working with agencies, as they might help identify shortcomings in their proposed strategies.

The “Guaranteed Returns” Promise: Any KOL promising specific price action is a major red flag. Legitimate crypto investments involve risk, and promises of guaranteed profits (e.g., “100x gains in a week”) are hallmarks of scams.

Lack of Transparency: KOLs who are not upfront about their portfolio or past promotions. Failure to clearly disclose sponsored content (e.g., #Ad, #Sponsored) violates regulatory guidelines and erodes audience trust.

Poor Community Management: KOLs with communities full of bots, spam, and low-quality engagement. This indicates a fabricated audience and means any promotion will not reach genuine potential investors or users.

One-and-Done Campaigns: Lack of follow-up and long-term vision. KOLs who accept payment for a single post and then disappear, or promote another project immediately, show a lack of genuine commitment to the project they promoted.

Overall, the best way to avoid being targeted by poor-quality KOLs with questionable practices is to cooperate with agencies that have spent years building their relationships with KOLs and have a proven track record of managing crypto social media marketing campaigns.

Final Thoughts on Crypto KOL Marketing for Ethereum Memecoins

Crypto KOL marketing for Ethereum-based memecoins is more important than ever. The pump.fun bull run was extremely impressive; it showed the power of decentralized token launcher platforms and demonstrated the massive amount of demand for low-quality memecoins.

The Solana-memecoin surge also resulted in an unprecedented number of rug pulls and scams, which dented trust in the market. As the Ethereum ecosystem rebounds, memecoin teams should be thinking about how to recover lost trust, and one of the most effective ways to do this is through KOL marketing campaigns.

FAQs

Can you advertise crypto casinos on Facebook?

Meta Platforms allows online gambling advertising with strict permission and policy adherence. Ads must comply with local laws and often focus on “social casino” or free-play content. This requires careful navigation of complex guidelines for crypto casinos.

What is the best ad network for crypto gambling sites?

The best ad network for crypto gambling sites depends on specific campaign goals. Leading networks specialize in crypto and iGaming focus, offering advanced on-chain and behavioral targeting.

How do you target crypto users with programmatic ads?

Targeting with programmatic ads involves geo-location, device, and interest filters. Advanced methods include behavioral targeting based on crypto site visits or token holdings. Contextual targeting places ads on crypto news and analytics sites.

What is a good CPA for a crypto casino player?

A good CPA (Cost Per Acquisition) for a crypto casino player varies significantly based on market dynamics, game type, and the player’s potential lifetime value. Industry benchmarks suggest CPAs for depositing players can range widely, with high-value individuals justifying higher acquisition costs.

Is it legal to advertise crypto casinos in the USA?

Advertising crypto casinos in the USA is highly complex due to fragmented state and federal regulations. While some states permit online gambling, operating crypto casinos within the US faces significant legal hurdles. Advertisers must navigate platform policies and local laws with caution.