Decentralized finance has shaken the foundations of the traditional financial industry. For a long time, serious financial institutions tried to ignore DeFi, smearing projects as short-term speculative attempts at leveraging blockchain technology for something other than memecoins and NFTs. In 2025, this attitude toward DeFi has been washed away.

Billions of dollars are locked in DeFi protocols where users can earn interest on their holdings, apply for loans in seconds, and leverage complex trading tools backed by smart contracts that guarantee transparent and secure transactions.

DeFi is growing every day. Major financial institutions are getting involved, competition for users is increasing, and the leading projects are now institutions in their own right. All of this has been built without relying on the centralized authorities that run the traditional financial world.

The primary goal of DeFi projects is to grow their total value locked (TVL). As the market expands, so do the opportunities for new projects to carve out their market share. DeFi marketing strategies increase the capacity of projects to claim their share of this growing ecosystem.

Why TVL Matters for DeFi Projects

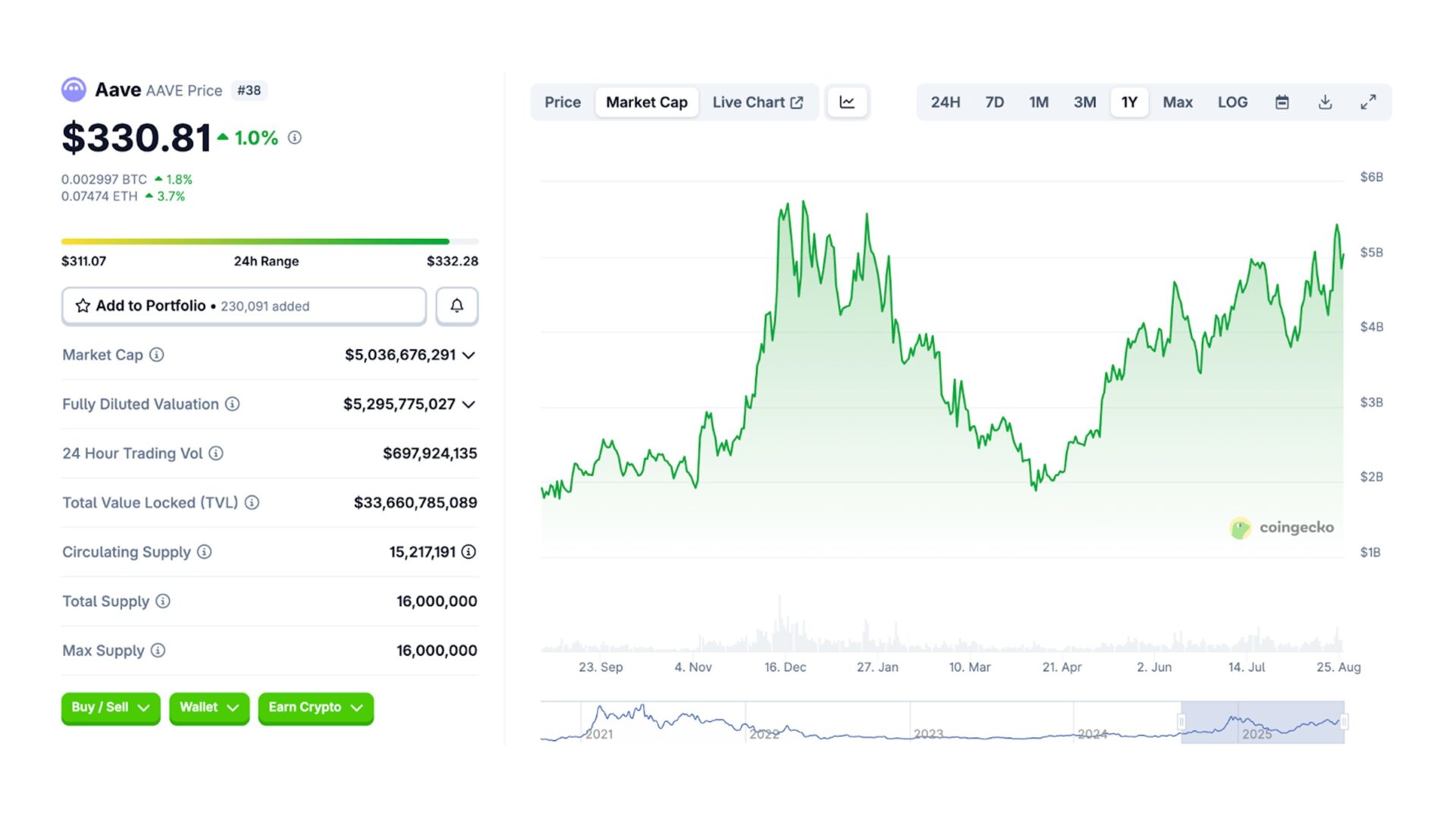

TVL is the key metric for measuring the success and authority of DeFi protocols. The leading DeFi platforms like Aave and Morpho have billions of dollars locked across multiple chains. It has taken these protocols years of investment in marketing and technology to build their positions as leaders in the market.

However, new projects have also shown that TVL can be grown quickly if the marketing and technology driving the project are effective.

TVL is more than just a number. It serves as a trust signal. The more capital a project has locked in its contracts, the more credible it appears to both retail users and institutional investors. Large TVL figures communicate security, reliability, and strong adoption.

TVL also directly influences token value, investor confidence, and network effects. Aave, for example, has seen its token price increase by more than 150% in the past 12 months as its TVL surged, reinforcing the link between liquidity growth and token appreciation.

The Challenges of Growing TVL in 2025

Dozens of new DeFi projects are launched every week, meaning that even if the pie is growing, the competition for every bit of TVL is a challenge. Established protocols have already come to dominate considerable portions of the market. But this shouldn’t discourage new projects. You only need to look at the success of Hyperliquid to see that there are still plenty of opportunities for disruption.

The real difficulty lies in breaking through the noise. Without strong marketing strategies, even technically excellent projects risk being overlooked. In 2025, attention is one of the scarcest resources in crypto, and user acquisition is heavily tied to visibility.

Communities, KOLs, PR, and SEO all shape perception, and projects that fail to invest in these tools often struggle to attract liquidity. For new DeFi teams, mastering marketing is just as critical as building secure smart contracts.

Crypto SEO: Driving Relevant DeFi User Traffic

Crypto SEO helps DeFi projects build steady streams of relevant traffic by giving the protocol’s website and app authority across search engines. The leading protocols and even centralized exchanges (CEXs) offering DeFi tools have deployed massive resources into dominating relevant search terms and pleasing Google’s algorithm.

At its core, SEO is about optimizing content and structure so that search engines rank a project highly for valuable keywords. For DeFi projects, this involves multiple elements:

Technical SEO: ensuring site speed, UX, and mobile optimization.

Crypto Link Building: securing backlinks from authoritative crypto publications.

Keyword Research: targeting keywords with solid volume and achievable difficulty.

Content Creation: producing blogs, guides, and updates that match what users are searching for.

A strong example is Aave. By ranking highly for USDC lending-related keywords, Aave has consistently funneled new users into its ecosystem. This has helped it grow both TVL and token value.

PR and Authority Building

Crypto press release distribution is critical to building the brand and, therefore, the TVL of projects, especially if they are just getting started or launching new features. A well-crafted PR can establish authority, attract investor attention, and create the perception of legitimacy that drives user adoption.

For DeFi projects, PR Articles in top-tier outlets like CoinTelegraph, Decrypt, or Bloomberg Crypto lend credibility that paid ads or organic posts cannot match. They act as third-party validation, showing that respected voices in the industry see the project as worth covering.

When integrated into broader campaigns, PR also supports SEO and link-building, amplifying a project’s online presence. By consistently publishing high-quality PRs, DeFi projects can shape their narrative, strengthen investor confidence, and grow TVL through brand authority.

KOL and Influencer Campaigns for DeFi

Crypto influencer marketing is a complicated area of the Web3 marketing industry. The leading figures and key opinion leaders (KOLs) hold massive amounts of soft power in the market. Many of them can single-handedly move charts and impact the long-term growth of DeFi protocols and their native tokens. Ignoring them is not an option, but simply throwing money at KOLs is extremely risky.

Agencies play a critical role in helping projects negotiate terms with top-tier KOLs and influencers. They ensure campaigns deliver the best returns on spend, avoid scenarios where KOLs dump tokens allocated for promotions, and filter out low-quality influencers who offer little real value.

The risks of poor KOL selection are significant. Choosing the wrong partner can result in wasted budget, price crashes caused by token dumps, and a negative reputation that can harm future growth.

For DeFi projects, compatibility is crucial. There is little point in collaborating with a KOL whose following consists mostly of memecoin traders when the goal is to onboard liquidity-focused investors. Expert crypto marketing agencies connect projects to DeFi-focused KOLs, ensuring alignment between the influencer’s audience and the project’s goals.

Case Study: Hyperliquid as a DeFi Success Story

Hyperliquid is one of the standout newcomers in the DeFi space. The Layer-1 chain launched in late 2024, and it quickly positioned itself as a serious competitor to legacy networks.

According to DeFiLlama, total value locked across all its dApps and DeFi tools grew from virtually $0 in December 2024 to more than $2.4 billion by August 2025. This explosive rise demonstrates how quickly a well-executed project can attract liquidity when the fundamentals and marketing align.

Part of Hyperliquid’s success comes from utility. Its ecosystem includes high-performance decentralized exchanges, lending markets, and derivatives protocols designed to deliver low fees and fast settlement. These tools gave users compelling reasons to lock up capital.

Equally important was its marketing. The project invested in professional PR campaigns, influencer partnerships, and targeted community building that created buzz and trust early on. By combining strong technical offerings with a polished narrative and clear communication, Hyperliquid attracted not just speculators but also long-term liquidity providers.

Hyperliquid shows that even in a competitive market, new protocols can rapidly scale TVL with the right mix of utility and comprehensive DeFi marketing.

Final Thoughts on How DeFi Projects Can Increase TVL with Marketing

DeFi has had an incredible 12 months. Following the 2022 crash, a recovery began in 2023 through 2024, and this year things have really taken off with the total value locked across leading platforms hitting all-time highs. The leading protocols successfully leveraged technically sound smart contract solutions combined with DeFi marketing strategies to position themselves as industry leaders.

FAQs

How can DeFi projects increase TVL?

DeFi projects can increase TVL by combining secure, innovative smart contracts with effective marketing. SEO, PR, KOL campaigns, and programmatic ads attract new users, while strong communities help retain them. Together, these strategies build trust and liquidity inflows.

What is TVL in DeFi?

TVL, or Total Value Locked, measures the amount of crypto capital deposited into a DeFi protocol’s smart contracts.

How can crypto marketing be used to increase DeFi TVL?

Crypto marketing builds visibility and credibility, encouraging investors to deposit funds into DeFi protocols. Tools like crypto SEO, PR campaigns, and influencer partnerships help projects stand out, attract liquidity, and position themselves as trusted platforms.