The total value locked (TVL) across all chains has surged from under $40 billion to over $140 billion in the past six months. The astonishing recovery of the market has been accompanied by Bitcoin hitting repeated new all-time highs, as the crypto industry appears to be on the cusp of mainstream adoption.

This increasing TVL presents a huge opportunity for both new and existing DeFi protocols to grow their market share and expand their user base. As capital flows back into the ecosystem, projects that position themselves early stand to benefit the most.

Decentralized exchanges (DEXs), yield farming platforms, and lending protocols are now looking to claim their share of these capital inflows. One of the biggest challenges facing teams building these essential DeFi tools is standing out through effective DeFi marketing.

The most successful DeFi protocols leverage crypto marketing tools like Meta ads and crypto SEO to build brand authority, drive traffic, and, most importantly, grow total value locked.

The DeFi Market in 2025: Total Value Locked Surges

The DeFi market has entered a clear bull market in 2025. As Bitcoin hits new all-time highs, capital has flooded into the DeFi sector, with Ethereum, Tron, and Solana experiencing massive surges in demand. Solana, in particular, has been very successful, growing its total value locked (TVL) from under $300 million in 2022 to over $10 billion as of July 2025.

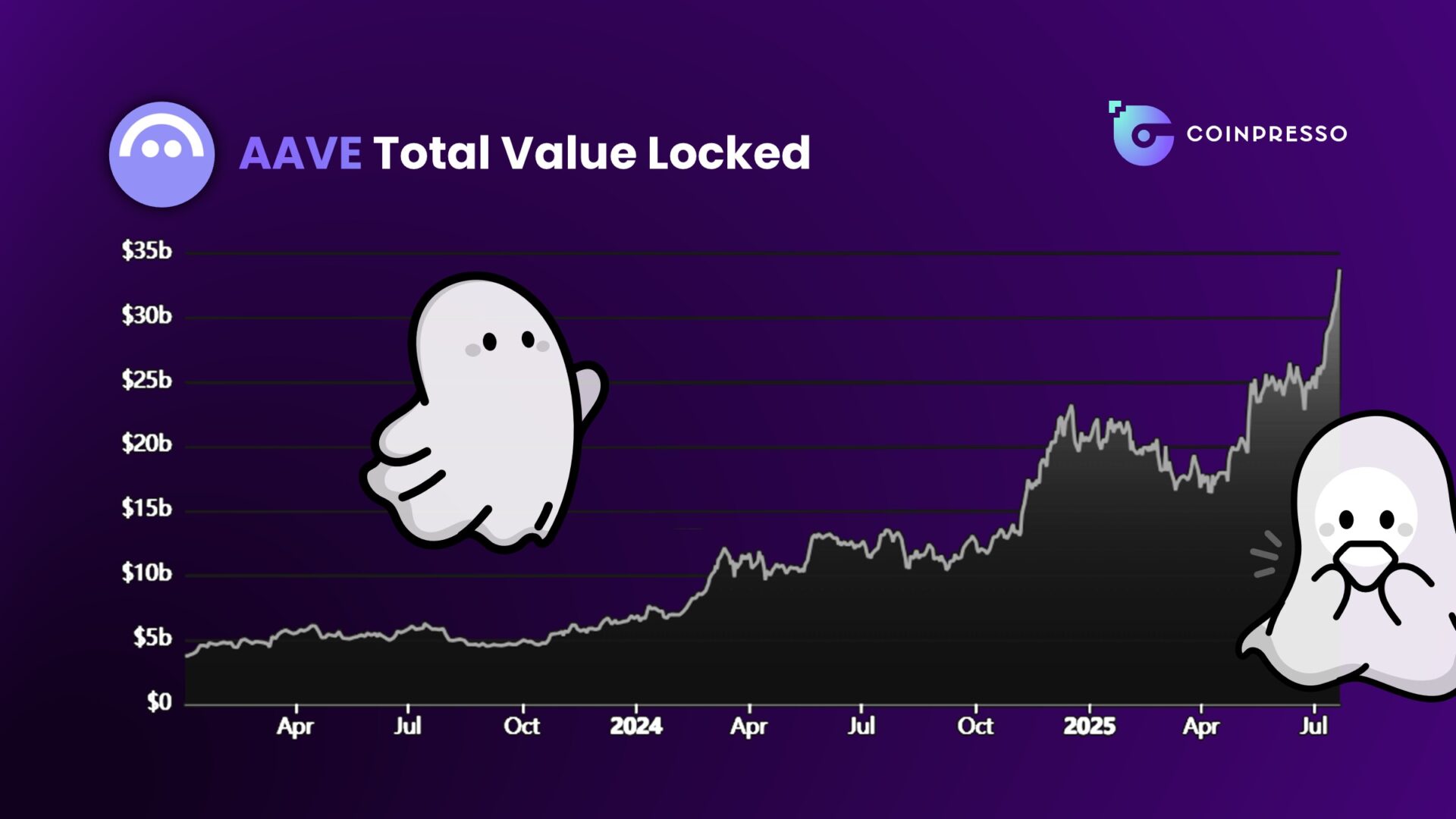

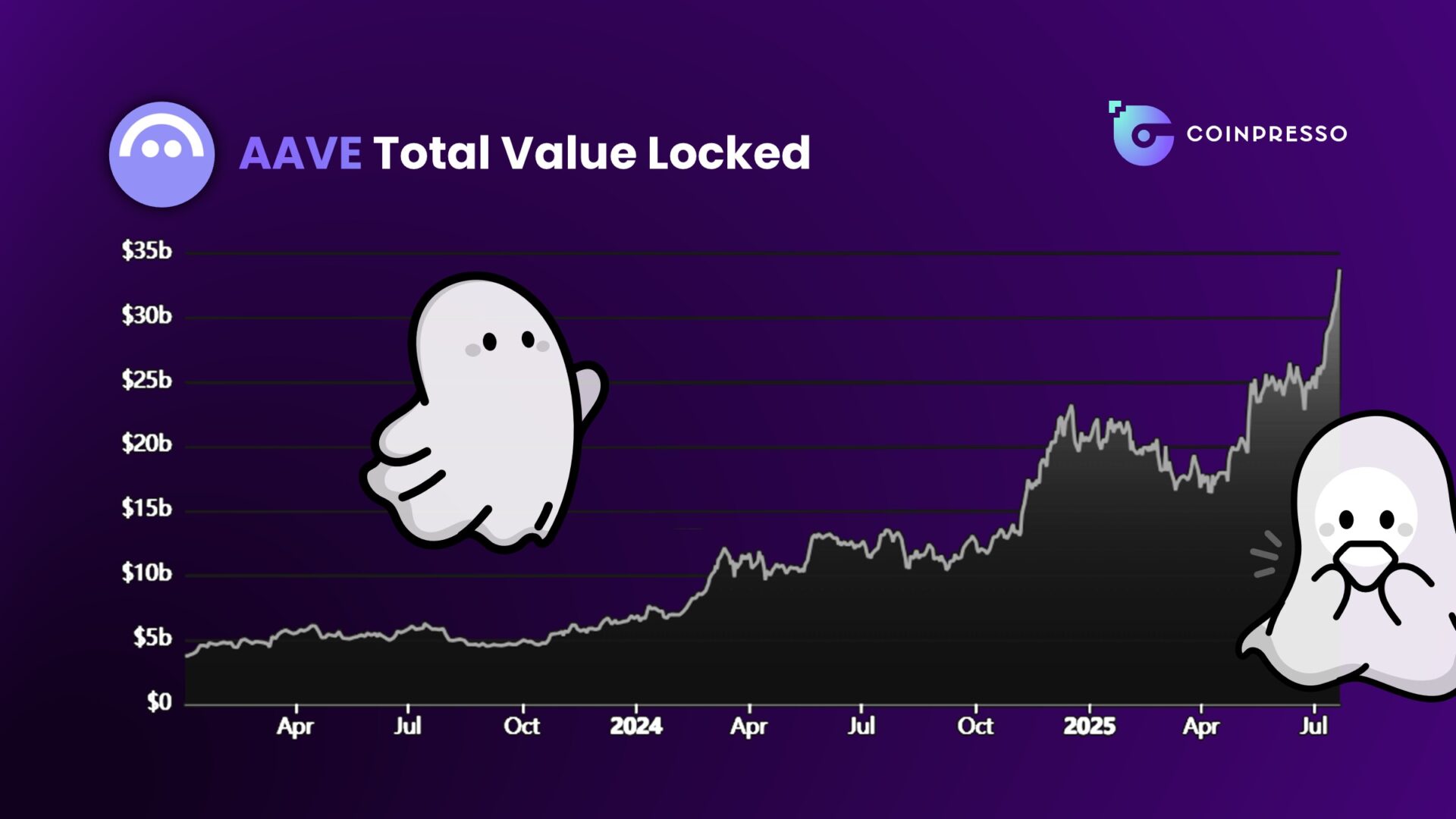

Total value locked is widely recognized as the leading indicator for measuring the success of a DeFi protocol. For example, AAVE currently has over $30 billion locked across multiple chains, while Spark Protocol holds more than $8 billion in assets. These figures highlight how TVL serves as a direct measure of a protocol’s trust, adoption, and overall health.

If this trend continues, it is entirely possible that total value locked across DeFi will exceed $200 billion. This is especially likely if institutional adoption continues to grow. Now is the time for new protocols to position themselves using expert crypto marketing solutions like SEO, paid ads, and PR to secure first-mover advantage and capture market share.

How to market a new DeFi protocol in 2025 for TVL Growth

With hundreds of billions of dollars up for grabs, the DeFi market has become one of the most competitive niches in crypto. The only projects that can hope to succeed are those that combine cutting-edge utility with multi-faceted crypto marketing campaigns. The leading DeFi protocols have generally collaborated with top crypto marketing agencies to unlock their full potential and grow their TVL at a steady rate.

SEO for DeFi: Capturing High-Intent Users

Crypto SEO is a critical pillar of the DeFi marketing funnel. A comprehensive and consistent DeFi SEO campaign can position projects to build relevant traffic streams from users with high intent. Although SEO requires more resources and time than some short-term marketing tools, it is undoubtedly one of the most potentially lucrative options for DeFi marketing teams.

Coinbase offers a great example of successful DeFi SEO. For keywords like “crypto USDC lending,” Coinbase ranks at the top of Google search results. This visibility has helped the exchange grow its DeFi services, including USDC lending, by capturing high-intent search traffic.

Looking deeper at the Coinbase example, their SEO success comes from building site authority through backlinks, quality content, and strong technical SEO. Technical elements like page speed, structured data, and mobile optimization help improve rankings and maintain visibility for competitive keywords.

DeFi projects aiming to build traffic streams like Coinbase should collaborate with expert crypto SEO agencies. These agencies can provide the technical skills needed to rank for valuable keywords and help identify lower-competition search terms with solid search volume.

DeFi KOL Marketing

Crypto influencer marketing can play a pivotal role in growing a DeFi protocol’s user base and, ultimately, its total value locked. The most respected key opinion leaders (KOLs) and influencers in the crypto market have the capacity to significantly boost the brand of a new DeFi project and onboard new users, whether it be to a DEX or a lending protocol.

KOL marketing agencies use their industry positions to build long-term relationships with top influencers. They handle the full process, from negotiating token allocations and creating sponsored post agreements to organizing video reviews and tweet threads. Typically, influencers promote new DeFi projects through content on platforms like X and YouTube, helping generate awareness and credibility.

It’s important to work with respected KOL managers and agencies, as they have direct access to top influencers and understand how to structure deals that avoid heavy token dumping from KOLs. This protects the project’s price stability while maximizing marketing impact.

Meta Ads for DeFi Protocols

Billions of users rely on Meta platforms for news, social media, and even online shopping. As more users are onboarded into DeFi, platforms like Facebook and Instagram will become some of the most valuable sources of new community members for DeFi protocols. Facebook crypto advertising can quickly become a viable source of TVL growth for DeFi teams when campaigns are properly set up, managed, and optimized.

Most DeFi projects work with external Meta ads specialists who understand how to create effective creatives and banners, gather data reports, adjust ad campaigns, and, most importantly, ensure all campaigns comply with Meta’s strict regulatory requirements for crypto advertising. This professional oversight helps projects avoid bans while maximizing ad performance, audience targeting, and overall return on ad spend.

Measuring DeFi Marketing Success: The TVL-Centric Dashboard

Evaluating DeFi marketing success requires a focus on both traditional and blockchain-specific metrics, all feeding into a TVL-centric dashboard. This comprehensive approach allows protocols to accurately assess their growth and the impact of crypto marketing.

Primary KPIs:

Total Value Locked (TVL): This is the ultimate health metric, reflecting user trust and the amount of capital committed to the protocol. Consistent TVL growth signals strong market confidence and utility.

Daily/Weekly Active Users (DAU/WAU): These measure real usage and consistent protocol engagement. A growing number of active users indicates a healthy and expanding community interacting with the dApp.

Protocol Revenue/Fees Generated: This metric is a sign of a sustainable business model and actual economic activity within the protocol. It demonstrates the real value proposition for both users and investors.

Secondary KPIs:

Community Engagement: Active members in Discord or governance forums indicate a vibrant user base. High participation suggests strong loyalty and a decentralized decision-making process.

Share of Voice: This measures brand mentions versus competitors across social media and news, reflecting market presence and brand awareness.

Page Views: This indicates serious user interest and a desire to understand the protocol’s mechanics, signaling potential long-term adoption.

Attribution modeling is crucial to understand which marketing efforts contribute most to these key metrics. Sophisticated tracking helps identify the most effective channels, allowing teams to optimize marketing spend for maximum impact and TVL growth.

Final Thoughts on DeFi Marketing in 2025

The DeFi market is experiencing a massive surge in demand. Total value locked has increased by over $100 billion in the past 12 months, and more growth is forecast by the majority of analysts. Teams looking to launch a new DeFi protocol or drive adoption of existing protocols should be looking to support from leading crypto marketing agencies who have the capacity to get protocols noticed and grow TVL, especially as the market undergoes expansion.

FAQs

How do you calculate the ROI of a DeFi marketing campaign?

Track total value locked (TVL) growth, new user acquisition, community engagement, and protocol revenue against marketing spend. ROI should reflect both direct TVL gains and long-term brand growth driven by campaigns.

What is the most effective way to increase TVL for a new DeFi protocol?

A combination of paid ads, influencer marketing, SEO, and PR works best. Strong tokenomics and reliable smart contracts help retain capital once onboarded. Paid media typically delivers the fastest early-stage TVL growth.

Are airdrops still an effective marketing strategy for DeFi?

Yes, but with caution. Airdrops attract users but can also bring short-term opportunists. Best results come from targeted, utility-based airdrops combined with other marketing channels to retain genuine users.

How do you market a DeFi project without a large budget?

Focus on organic channels like crypto SEO, community building on Discord and X, and influencer partnerships with small-to-mid-tier KOLs. Prioritize consistent, educational content to build authority.

What role does community play in the success of a DeFi platform?

Community is critical. A strong, engaged community drives user retention, governance participation, and word-of-mouth marketing, which can significantly boost TVL and overall project stability.