Seattle’s Neon Machine secured $19.5 million in funding led by Gala Games to globally launch Shrapnel, focusing on the Chinese market with testing commencing in 2025.

This funding boosts Shrapnel’s entry into China’s regulated web3 gaming space, leveraging Gala tokens and NFT trading, potentially reshaping blockchain gaming dynamics.

Neon Machine’s Multi-Million Dollar Vision for China’s Game Market

Neon Machine’s $19.5 million funding round, led by gala games, includes participation from Griffin Gaming Partners and Polychain Capital. Funds will support Shrapnel’s global launch, with a focus on China. GalaChain will serve as the blockchain foundation, requiring GALA tokens for game-related transactions.

The partnership with China’s Trusted Copyright Chain enhances regulatory compliance and web3 capabilities, enabling Shrapnel to enter the Chinese market in 2025 and offering NFT trading in RMB. Gala tokens will play a crucial role in Shrapnel’s cross-chain transactions.

“This investment comes at a pivotal juncture as we aim to redefine the standard gaming narrative,” — Mark Long, CEO, Neon Machine

Neon Machine’s initiative has not triggered notable statements from industry key figures. However, the collaboration with Gala Games secures Shrapnel’s foothold in China’s market, emphasizing Gala tokens’ importance.

Gala Tokens and Regulatory Compliance: The Future of Shrapnel

Did you know? Neon Machine’s Shrapnel marks the first foreign web3 game licensed on China’s Trusted Copyright Chain, setting a historic precedent for regulated game entry into China’s market.

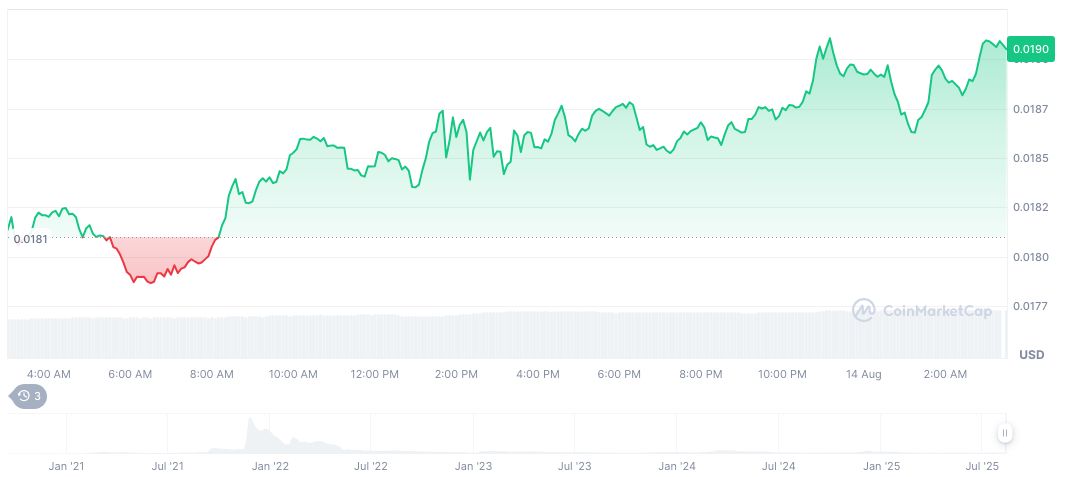

As of August 14, 2025, Gala (GALA) is priced at $0.02, with a market cap of $871,601,671. Its trading volume over the last 24 hours reached $177,114,209, marking a 5.60% rise. Circulating supply: 45.63 billion out of a maximum of 50 billion, as reported by CoinMarketCap.

The Coincu research team suggests that Shrapnel’s entry could boost Gala Games’ market stature and NFT trading within regulated frameworks. Historical precedent highlights potential for increased investment flows, yet direct effects on broader cryptocurrency prices remain muted.